FanDuel Sportsbook is live in Michigan. While you’ve likely heard of the company because of Daily Fantasy Sports, its second act as an online bookmaker and casino has made it a household name. With a user-friendly mobile app, lucrative promotions, and an excellent retail partnership with Detroit’s Motor City Casino – MI bettors have flocked to FD Sportsbook in record numbers. This page will cover all elements surrounding FanDuel Sportsbook in Michigan. We’ll detail how to create an account, claim a bonus, deposit, cash out, and more.

UPDATE: FanDuel is now available in North Carolina with a great welcome offer! Live in North Carolina: Bet $5, Get $200 in Bonus Bets!

FanDuel Sportsbook Promo Code Details

| FanDuel Michigan Promo Code | Just click this link |

| Bonus Offer | Live in North Carolina: Bet $5, Get $200 in Bonus Bets! |

| Bonus Valid | August 2023 |

| MI License Partner | Motor City Casino |

| MI Online Launch | Jan. 22, 2021 |

So, how does the Live in North Carolina: Bet $5, Get $200 in Bonus Bets! offer work exactly?

Make an initial deposit of at least $10 and then simply place your first real-money wager of at least $5. Win, or lose – you will be in line to receive $150 in bonus bets! What a deal!

Always make sure you read the most recent terms & conditions for more details on FanDuel’s latest welcome bonus.

Gambling Problem? Call 1-800-GAMBLER. Hope is here. Gamblinghelplinema.org or call (800)-327-5050 for 24/7 support (MA). Call 1-877-8HOPE-NY or Text HOPENY (467369) (NY). 21+ and present in AZ, CO, CT, IA, IL, IN, KS, LA (permitted parishes only), KY,MA, MD, MI, NJ, NY, OH, PA, TN, VA, VT, WV, or WY. FanDuel is offering online sports wagering in Kansas under an agreement with Kansas Star Casino, LLC. Gambling Problem? Call 1-800-GAMBLER or visit FanDuel.com/RG (CO, IA, MI, NJ, KY, OH, PA, IL, TN, VA, VT), 1-800-NEXT-STEP or text NEXTSTEP to 53342 (AZ), 1-888-789-7777 or visit ccpg.org/chat (CT), 1-800-9-WITH-IT (IN), 1-800-522-4700 or visit ksgamblinghelp.com (KS), 1-877-770-STOP (LA), visit www.mdgamblinghelp.org (MD), 1-800-522-4700 (WY), or visit www.1800gambler.net (WV).

FanDuel Sportsbook Reputation: Top Shelf

Since its first online sportsbook launched in September 2018, FanDuel has been a frontrunner in the nascent U.S. industry. Sure, the company benefited from having established itself as a superpower in both the sporting world and iGaming through its Daily Fantasy Sports success, but that’s not the lone reason for its sports betting growth.

FanDuel offers an online betting experience and mobile app that is truly top-notch. It’s easy to deposit, place bets, browse markets, talk to support, etc. Plus, having held and paid out millions daily, for years, you never have to sweat the security of your betting bankroll.

FanDuel is owned by one of the world’s largest, and most trusted gaming corporations. The FanDuel Group was acquired in 2018 by Paddy Power Betfair, which underwent a significant rebrand the following year to Flutter Entertainment. Flutter controls an impressive lineup of globally recognized iGaming brands including FOX Bet, PokerStars, Betfair, Paddy Power, Adjarabet, and more.

Who can bet on sports in Michigan?

Getting set up to place a bet with FanDuel Sportsbook will only take a few moments – you’ll be ready to go before you know it. Before we show you how though, you’ll want to make sure you’re eligible to bet on sports in the state of Michigan. Any person who meets the following criteria is good to go:

- Age: 21+

- Location: You must be located inside of the state of Michigan

… and that’s it. As long as you’re in Michigan, and of age, you’re free to join in on the action with FanDuel Sportsbook.

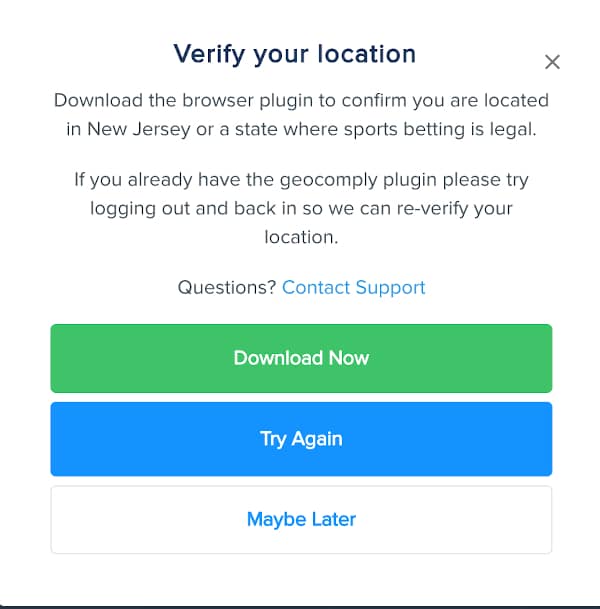

Proof of Location

FanDuel and other state-regulated sportsbooks rely on geolocation to confirm a bettor’s whereabouts. Before any bet can be placed, a special plugin needs to be downloaded to your computer and activated. Using your WiFi signal, it can pinpoint your location in real-time and relay it over to FanDuel. When betting from the FanDuel sportsbook mobile app no extra download is needed; as long as it can link to your phone’s GPS, you’re all set. It doesn’t matter if you’re in the U.P. or enjoying a layover in the Detroit airport. As long as you’re in the state, you can bet. Keep a lookout for the following message to pop up when entering the book for the first time. Click ‘Download Now’, and you’re all set.

FanDuel Sportsbook Account Setup

Upon heading over to the FanDuel Sportsbook website for the first time you’ll be prompted to select your state, but all you need to do is choose the Michigan tab to sign up for an account. FanDuel is in about a dozen states now, which is good news if you like to bet on sports when you travel. It is very easy to use your FanDuel account to bet in other states with legal sports betting.

Once you are in the Michigan-specific version of the FanDuel Sportsbook, the app or website will automatically load the signup form. You will be required to provide some personal information here. Keep in mind that FanDuel is regulated by the Michigan state government, so everything is official and above board – your details will be kept safe using industry-standard privacy technology.

You will need to provide your name, address, phone number, and date of birth. You’ll also have to pick a username, set up some security questions in case you get locked out of the account and need to recover it, choose a password, and last but not least – provide the last four digits of your SSN. Again, no need to worry – there’s nothing sketchy about the process. Once the site has what it needs, you should be ready.

Banking Made Easy

Another great feature of FanDuel Sportsbook is its expansive cashier. The site already runs Daily Fantasy Sports contests across the country and is adept at both collecting and paying out money – and it can do it fast. FanDuel has more banking options than any other sportsbook, including:

- Credit and Debit Cards like Visa, MasterCard, and Discover.

- FanDuel Prepaid Play+ cards are another easy to fund, easy-to-use method for moving money to and from FanDuel.

- The eWallets PayPal and Venmo (owned by the same company) are both available and are another great way to add funds to your account and cash out with speed.

- FanDuel supports Online Bank Transfers, where using the online bill pay feature with your online bank you can transfer funds over by following a few simple steps. Lots of national banks like Bank of America, Chase, SunTrust, and Capital One are all eligible… plus plenty of smaller ones, too.

- Depositing to FanDuel with cash at the local 7-Eleven? Yep – the future is now. Using the popular PayNearMe service Michigan bettors will be able to initiate a deposit online, then bring cash to participating retail chains like 7-Eleven, Family Dollar, and CVS to deposit there. Your cash will be made available online for immediate use.

- If you’re in the Detroit area you can deposit with cash in-person at the Motor City casino cage.

- A Bank Wire may not be the fastest option, but it’s a great way to move larger sums of money.

- Paper checks are also a common withdrawal option if you have time to wait for the mail.

- Apple Pay is also available. This is unusual among sportsbooks but is great for those who want to use Apple Pay the same way they pay for other everyday items.

- Gift Cards are also a new way to fund your FanDuel account. Buy them wherever gift cards are sold and use the funds to load up your account. Give the gift of sports betting this holiday season.

Remember that not all methods that are available for deposits will be options for withdrawals. Plus, you may need to deposit with some banking methods before you are approved to use them for cash out – but that’s part and parcel for the industry. Regardless, your money will always be accessible.

Placing a Bet With FanDuel Sportsbook

The process of placing a bet is pretty straightforward and can be done from both a computer or a mobile device.

FanDuel Desktop Review

FanDuel’s sportsbook has all of the bells and whistles that customers have come to expect and then some, all wrapped up in a graphically pleasing interface. When you first log in you will be greeted with a list of the most popular ongoing and upcoming games. This makes it easy to get involved in live betting if time is of the essence. Account functions can be found at the top of the page, and a complete list of betting markets is available on the left.

Once you’ve found the right game – either click the bet that you want, or select ‘more wagers’ just below to see an expansive library of bets beyond the spread, Moneyline, or total. Once you’ve picked the wager it will appear on the right side of your screen within your bet slip. Type in the amount you want to bet and you’re all set.

FanDuel Sportsbook App Review

FanDuel offers an excellent mobile betting product. If you already have FanDuel installed on your phone for DFS, the sportsbook does require a separate download – though your balance can be shared. The overall look and feel are very similar to the desktop betting experience – and it can travel with you around the state. There are some small differences, like the betting slip appearing from the bottom as opposed to the right, but they all make sense for the smaller screen and are generally quite intuitive.

In case you were wondering, you never actually have to access FanDuel Sportsbook from your computer. You can download the mobile app, sign up, deposit, and do all of your account business in maintenance right from the app. It has it all.

FanDuel Sportsbook – Setting the Pace in Michigan

Bettors flock to the site because simply put, FanDuel offers a great product. You can deposit money to FanDuel and place bets with confidence, knowing that the strictest safety and security standards are being upheld. What’s more, FanDuel won’t accept a single bet in the state of Michigan until its obtained approval from the Michigan Gaming Control Board – the government agency tasked with making sure everything is legit.

If that wasn’t enough to assuage doubts, FanDuel has also secured a partnership with one of the largest brick-and-mortar casinos in the state of Michigan – the Motor City City Casino. Wagering with FanDuel will be considered no different than waltzing into the casino and placing a wager there.

What Can I Bet On at FanDuel Sportsbook Michigan?

If you’re new to the regulated sports betting industry in the U.S., you might be asking this question. So which sports are available for action on the FanDuel sportsbook, and what types of bets can you place? The simple answer is you can bet on just about any sport, in any way that you might like.

All major sports including football, basketball, baseball, soccer, and hockey will all be mainstays, however, that’s just the tip of the iceberg. You can wager on tennis matches, golf, cycling, rugby, NASCAR, cricket, darts, and of course, combat sports like boxing and MMA. If there is a sport that you follow, get ready to bet on it… and that extends to both college and professional leagues.

As far as the available bets, you can bet on the basics like the money line, spread, or total points. You can also bet futures, like who you think will win the league championship, or take home the MVP award. Props, parlays, and live betting are also available. With live, in-game wagering you can place bets as the event unfolds. Wager on the next play, shot, point, hole, etc. Live betting can’t be rivaled as far as engagement is concerned.

Same Game Parlays

FanDuel is a market leader in many things, including Same Game Parlays. This new type of bet took off in 2021, and FanDuel led the way by offering the most Same Game Parlay options and making it easy for bettors to use and understand. Back in the old days of 2020, sportsbooks didn’t let you create a parlay that included bets for the same game. They reasoned that, for example, if a favorite covers the spread, the over will likely hit as well. Why let people hit more parlays?

That reasoning may be true, but the people demanded Same Game Parlays, and they have been a boon for both bettors and sportsbooks. Now on FanDuel, you can load up on parlays any way you like, including totals, player props, spreads, and more. This very popular betting option has been led by FanDuel.

FanDuel Sportsbook Rewards

One of the lone strikes against FanDuel is its lack of a sports betting rewards program. The company does have an existing rewards structure for DFS that allows users to trade in points for entries into contests.

It is known as the FanDuel Players Club, and there is an entire Rewards Center dedicated to it, but they’ve yet to adapt it over to the sportsbook. We’ll remain cautiously optimistic that sports bettors will eventually gain access to something similar that can return a little value.

FanDuel Customer Support

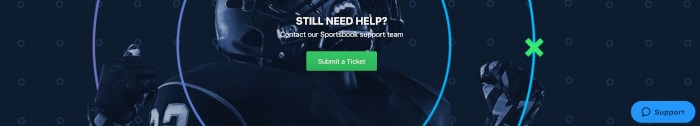

If you have questions about the sportsbook, answers are never far away. You will be able to find the ‘Help’ section at the bottom of the sportsbook, in the footer of the page. FanDuel offers a 3-pronged attack for combatting customer curiosity. It consists of a detailed FAQ, available Live Chat services, and an email form. At the bottom of the FAQ, you’ll find the latter two.

Select the ‘Submit a Ticket’ button to draft up an email to send to support. Live chat is available by clicking the little ‘Support’ bubble that appears in the bottom right corner, as seen here:

Clicking it will open up a chat window with a handy robot that tries, but often falls short of getting you where you want to be. We recommend clicking the available ‘Get in touch’ button as soon as possible to jump in with a real person. Overall, in our experience, FanDuel has always offered quality assistance.

More On FanDuel Sportsbook

New York-based FanDuel has been around for more than a decade, having established itself as one of the leaders (second only to DraftKings) in Daily Fantasy Sports.

Following the repeal of PASPA in 2018, FanDuel was one of the first online sportsbooks to go live in the state of New Jersey. Subsequent expansion has taken the site across the country, with bets now being accepted in Pennsylvania, West Virginia, Indiana, and as far west as Colorado… with no signs of a slow down.

In 2018 the prominent European bookmaker Paddy Power Betfair acquired FanDuel to use the company as its primary sports betting brand throughout the United States. A year later in 2019, Paddy Power Betfair rebranded to Flutter Entertainment. Just months later Flutter completed a multi-billion dollar takeover of The Stars Group, bringing sites like PokerStars and FOX Bet under its rapidly expanding net.

FanDuel has also ventured into the realm of online casinos. In New Jersey, Pennsylvania, and even Michigan. It has partnered with fellow Flutter brand, Betfair, for casino services. The first official FanDuel Online Casino launched in Pennsylvania in January 2020.

FANDUEL SPORTSBOOK VERDICT

Bottom Line

FanDuel has claimed a top-3 spot in every legal US sports betting market, and for good reason. FanDuel offers some of the best lines in the industry, tons of very generous promotional offerings, and lightning fast cashouts. You really can’t ask for more from an online sportsbook.

Overall Rating

FanDuel Sportsbook FAQs

Yes! The FanDuel Sportsbook app and website are both currently live and accepting wagers in the state of Michigan.

Yes, real money! FanDuel Sportsbook Michigan is a fully legal and licensed online sports betting service. Anyone who plays their cards right can win money with FanDuel.

Players can place a wager with FanDuel by opening the FanDuel Sportsbook Michigan mobile app or heading over to the brand’s desktop website. From there, simply enter your FanDuel Sportsbook login, pop some picks into your bet slip, and lock them in once ready!

FanDuel Michigan users are treated to a full array of different sports markets to choose from, including crowd favorites such as baseball, basketball, football, hockey, soccer, tennis, combat sports, and everything in between.

Not currently. The FanDuel welcome offer available in Michigan right now is a Bet $5, Get $200 in Bonus Bets!

No. Just click here. You do not need a specific promo code to get the latest FanDuel Sportsbook offer.

Yes! FanDuel Sportsbook is known for its loaded promotional schedule, constantly coming up with new ways to keep active players involved. If you already took advantage of your welcome bonus, be sure to stick around – it’ll be worth it!